Strategies for Lowering Investment Taxes

Choosing investments with built-in tax efficiencies helps you minimize returns lost to taxes. We recommend using EFTs as a foundation in most portfolios for the tax advantage. Due to the way the transactions settle, you can usually avoid triggering Capital Gains.

Look for Opportunities to Offset Gains

- You’re only taxed on net capital gains, so any realized losses can help lower your tax bill.

- If you know you’re going to have realized gains, look for opportunities to realize losses and offset them.

- For example, if you have shares of stocks that have lost value since you purchased them, you may consider selling them.

This is a Strategy known as “Tax Loss Harvesting.”

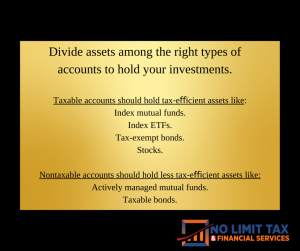

Divide assets among the right types to hold your investments.

Taxable accounts should hold tax‑efficient assets like:

Index mutual funds

Index ETFs

Tax-exempt bonds

Stocks.

Nontaxable accounts should hold less tax‑efficient assets like:

Actively managed mutual funds

Taxable bonds

If you have questions or would like to speak with one of our tax professionals about your situation.